How to Save Money Without Thinking About It

Please raise your hand if you’ve ever felt like more money is leaving your bank account than coming in. 🙋♀️

Saving as much as possible, especially in this stage of life, is a priority for me. I can only count on what I make and save for my future.

Not being one to cut or even use coupons, unless it’s a Bed, Bath & Beyond coupon. I mean, you can’t go wrong with those. Amiright?!

I’ve come across some easy ways to save more money while going about my normal life. And I thought you might be interested in learning how to do the same.

This post contains affiliate links, which means I may receive a small commission if you click a link and purchase something that has been recommended. While clicking these links won’t cost you any extra money, they will help keep this site up and running! Please check out the disclosure policy for more details. Thank you for your support!

3 Apps That Will Help You Save Effortlessly

Acorns App

With the Acorns app, you can save and invest your spare change.

How Acorns Works

There are multiple ways to save with this app.

Round-ups

When you spend any amount on anything, using a credit or debit card you have linked to your Acorns account, Acorns will round up your change to the nearest dollar and transfer that money from your linked checking account into your investment account once it reaches at least $5.

For example, if you spend $7.32 at Starbucks, Acorns will keep track of that 68 cents (the amount it takes to the next nearest dollar), until your total reaches $5 and then they’ll put that $5 into the investment account of your choice, for you.

So, instead of keeping your spare change in a jar, Acorns will invest it in the stock market so it has the chance to actually grow in a way it wouldn’t by sitting on your dresser or even in a savings account.

There is a $1.00 per month fee for using the Round-Ups feature.

They also offer multipliers up to 10x for the round-ups, to make savings even better and faster.

Recurring Deposits

You can set up a recurring deposit for as little as $5 per week, which adds up to $260 per year. Acorns will deduct the $5 (or any other amount) from your bank and add that weekly into the investment account of your choice.

Another option is to do a quick one-time deposit of any amount over $5, so if you come into some extra cash and want to invest it, you can do that too.

How do I get my money?

You can withdraw your money at any time.

Is it safe?

According to Acorns, all your data is protected by bank-level security and 256-bit encryption.

Learn more about Acorns and get a free $5 when you open an account here.

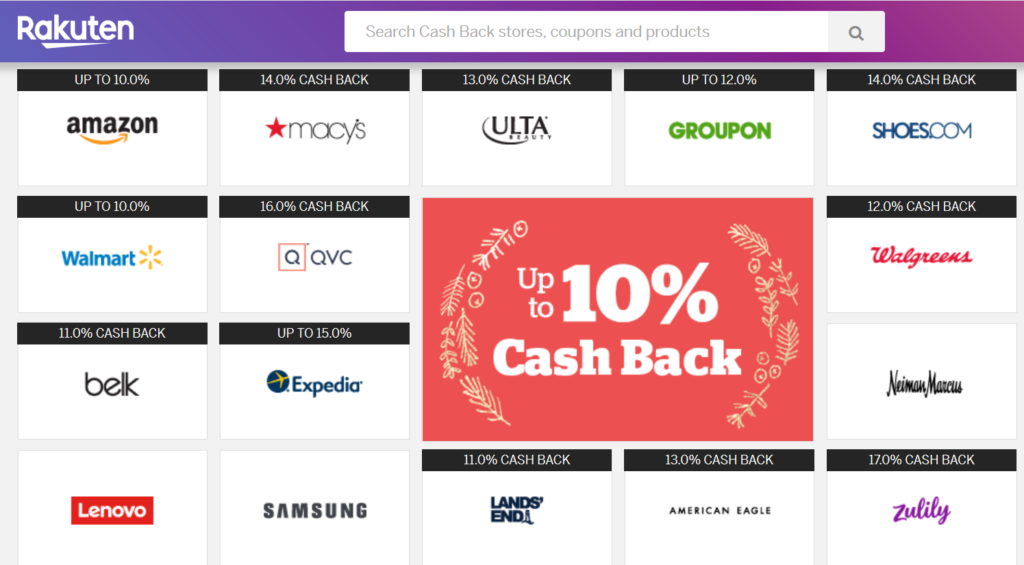

Rakuten (Rack-uh-ten)

If you’ve ever heard of E-bates, you know how Rakuten works. Since E-bates has been rebranded as Rakuten.

In a nutshell, stores pay Rakuten a commission for sending you their way and Rakuten shares that commission with you.

So, say you shop on Amazon a lot. You can go through the Rakuten App and start a shop, and get up to 20% back on your purchase, just by using the Rakuten app.

When you sign up and use this code, and spend $25 on anything in any of the stores you will receive $10. So your $25 purchase will only cost you $15 – how’s that for some awesome savings!

How It Works

After you sign up and get your account, anytime you feel like shopping online, open the Rakuten app or website and find the store you want to shop with.

Click on the store name, then click on ‘Shop Now’. This will open what Rakuten calls a “shop”. Rakuten will then send you to the online store through their link and you can shop and pay as you normally would. Except, this time, you will earn cash back on whatever you purchase, for doing nothing more than what you already do.

Easy peasy. Lemon Squeezy.

Will I receive the same discounts and sale prices?

Yes, the only difference when shopping through Rakuten is that you will also earn a rebate of up to 20% of your purchase, for using the app. Each store will show you how much the % is before you start shopping.

Which Stores Are Available?

There are over 650 stores that are available to shop through Rakuten. Below are just a handful. The range is wide!

Sign up for Rakuten here.

Do$h App

The Dosh app is super simple, too. You just connect a credit and or debit card and spend as you would anywhere, online or in person. Whenever you use your linked card, Dosh gets you up to 10% cashback, instantly and seamlessly.

These are just a few of the brands that Dosh is linked with:

Dosh is linked to thousands of stores, restaurants, and hotels. So, you’re bound to make cashback as you spend wherever you go. What I love the most about this app is that once you link a credit or debit card, you’re done. Do$h will do the rest for you automatically.

Once your balance reaches $25, you can transfer the balance to your checking account.

Dosh is available on both Apple and Google Play.

If you refer people to join with your personal referral code, you will receive $5 for each person that signs up and connects a card. Here’s my personal referral code, if you want to check it out. No pressure though.

Automatic Bank Transfers

Most banks will let you set up an automatic transfer from your checking to your savings account weekly or monthly. You can also check with your employer to see if you can have a set amount automatically transferred from your paycheck to your savings account so you won’t miss it when payday comes.

There you have it, three simple apps and a couple more ideas that can save and earn you money every time you shop. To me, there is no easier way other than of course, not shopping. And we know that’s not going to happen. 😉

Have you tried any of these ideas? What are your thoughts? Are there any others you’d add to this list? Haven’t used any of them, will you consider trying any? Tell me in the comments.

For blog updates, news, special offers and more, please subscribe at the button below.

Pin this article for later.

34 Comments

Charlene

I love saving money! These are some great resources.

Lee Anne

Good stuff! Thanks for sharing!!

Liza Brackbill

Gonna have to check out Acorns app. I think that one could be really helpful for me!

Barbara Johnston

OK, I think I will finally try the Rakuten app. I have been so skeptical about it. thanks for sharing some more insight into the app.

Lisa

Great ideas! Who doesn’t love saving money?!

Holly

You have some great ways to save money and these apps are nice..

My bank will do the same thing and I have been rounding up and auto deposit or transfer, it amazing how much you save

Danielle

Thanks Holly! Funny, I do the same with my bank and forgot to add it to the list. *face palm* Going to add it now. Thanks for the reminder.

Beth

Yup – this was amazing to read. Going to sign up for some of these right now. Thanks so much for posting and sharing this information.

Ankit Kumar

I like money saving tips. You made my day. Very nice article about money saving tips.

Tricia Snow

These are great tips! When I was a bank manager I always encouraged people to do an auto transfer to their savings.

Lisa

I like the idea of saving money effortlessly! I never have heard of acorn

Danielle

Yes, it’s the best! I love their tag line… “Grow your oak” 🙂

Maria Gustafsson

Great ideas, and all so easy!

Danielle

Thanks for reading Maria!

Erika

Wow, I’d never heard of these apps or sites before! Super cool. Thanks for sharing!

Danielle

Thanks Erika! Would love to know if you try any of them.

Suzan

Great tips…I hadn’t heard of many of these apps! Thank you for sharing them 🙂

Danielle

Thanks for reading Suzan! So happy you found it helpful.

Heather

Great apps! I like the one where you link your bank card and you don’t even have to think about it. I am going to check that out.

Danielle

Thanks Heather! Let me know what you think about it.

Eva

Great ideas here; I only knew about Rakuten. Love the idea of rounding up the change and sticking that in an account. I put all spare change from cash purchases in a jar every time I come home, and it adds up quickly!

Danielle

Thanks Eva! Yes, rounding up your change with Acorns is such a simple and easy way to save and invest.

Robin Frields

I love the Acorn app idea! Rounding your change seems like a great way to save money without thinking about it! Thank you- checking it out now!

Danielle

Awesome Robin! I love the ease of it! Thanks for reading!

judean

These are great tools! I have Rakuten but haven’t really had the time to research it further…I don’t shop online that often – only on Amazon. So, the next time I order from there, I will need to use my Rakuten app.

Danielle

Thanks! I appreciate you stopping by!

Carrie

I have been meaning to try Acorn. I’m happy to know that you recommend it!

Danielle

It’s a great and easy way to save and invest. So glad you stopped by. Thank you!

KENDRA

Thanks! I’m using Rakuten now, but will look into the others for sure.

Danielle

Awesome! Thanks for reading!

Katherine Wolfe

Who doesn’t want to save money?!?!?! Great suggestions, thanks!

Danielle

Exactly! Thanks for reading!!

Susan

Anything that gives you cash back is a win-win in my book so thank you for researching this and giving us all this great and extremely useful information.

Cindy

These seem like awesome apps that are easy to use. I’ll check them out!